Get This Report on Annuities In Toccoa, Ga

Six out of every ten uninsured adults are themselves used. Working does enhance the probability that one and one's family members will have insurance policy, it is not a warranty. Even participants of families with 2 permanent breadwinner have nearly a one-in-ten possibility of being without insurance (9. 1 percent uninsured price) (Hoffman and Pohl, 2000).

1 and 3. 2 (Health Insurance in Toccoa, GA), for more details. New immigrants represent a considerable percentage of individuals without medical insurance. One evaluation has associated a considerable section of the current development in the dimension of the united state without insurance population to immigrants who showed up in the country between 1994 and 1998 (Camarota and Edwards, 2000)

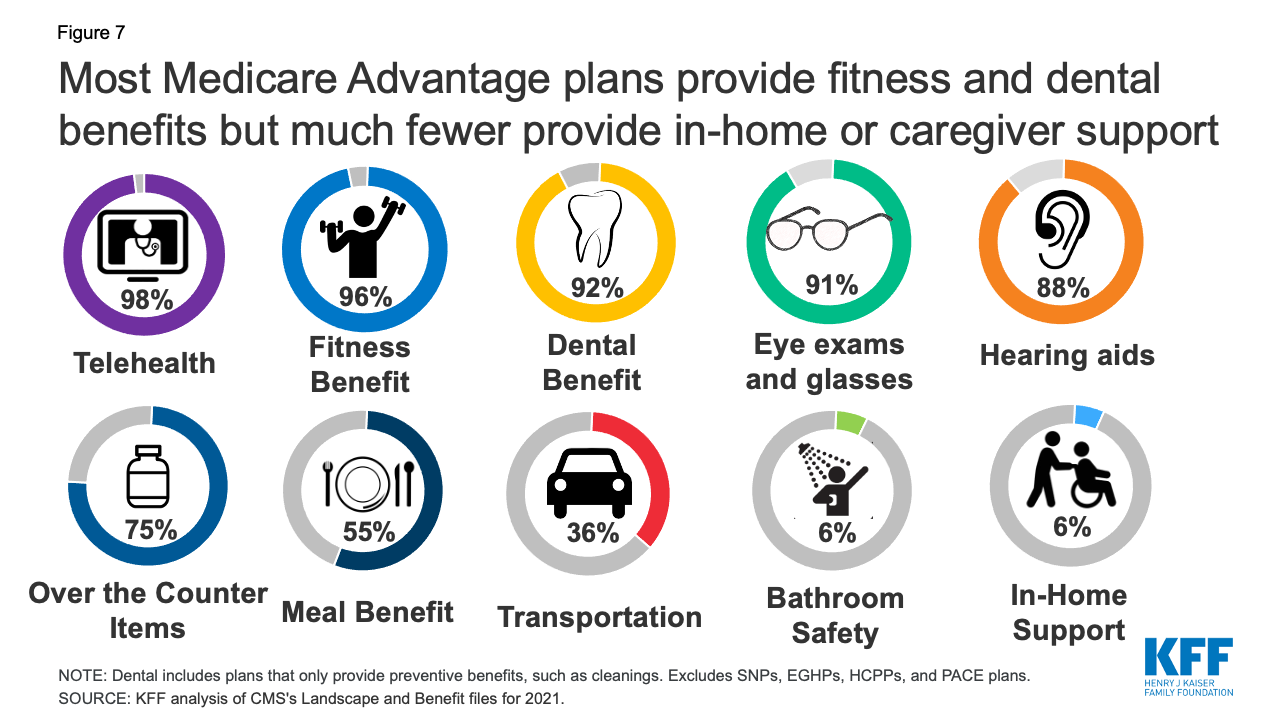

Health insurance policy insurance coverage is an essential element in a lot of versions that show access to healthcare. The partnership in between medical insurance and access to care is well developed, as recorded later in this phase. Although the relationship between health and wellness insurance coverage and health results is neither straight neither simple, a considerable professional and health services research literary works web links wellness insurance policy coverage to improved accessibility to care, better high quality, and improved personal and populace wellness standing.

Affordable Care Act (Aca) In Toccoa, Ga Can Be Fun For Anyone

The issues dealt with by the underinsured are in some respects comparable to those encountered by the uninsured, although they are normally much less severe. Wellness insurance policy, however, is neither required nor sufficient to obtain accessibility to clinical solutions. The independent and straight impact of health and wellness insurance policy coverage on accessibility to health solutions is well established.

Others will obtain the health treatment they need also without medical insurance, by paying for it out of pocket or seeking it from providers that supply care complimentary or at highly subsidized prices - Annuities in Toccoa, GA. For still others, health i thought about this insurance coverage alone does not ensure invoice of treatment due to various other nonfinancial barriers, such as a lack of healthcare suppliers in their community, limited access to transportation, illiteracy, or etymological and social differences

The smart Trick of Life Insurance In Toccoa, Ga That Nobody is Talking About

Official research study about without insurance populations in the USA dates to the late 1920s and early 1930s when the Committee on the Price of Healthcare produced a series of reports concerning financing medical professional office check outs and hospital stays. This issue ended up being salient as the varieties of medically indigent climbed up throughout the Great Clinical depression.

Empirical researches constantly sustain the web link between access to care and boosted wellness outcomes (Bindman et al., 1995; Starfield, 1995). Having a regular resource of treatment can be considered a predictor of gain access to, instead of a direct action of it, when health and wellness results are themselves made use of as access indications. Health Insurance in Toccoa, GA. This extension of the idea of gain access to measurement was made by the IOM Committee on Checking Accessibility to Personal Health Care Services (Millman, 1993, p

Nonetheless, the impact of parents' health and wellness and health and wellness insurance on the wellness of their kids has gotten focus just just recently. Whether or not parents are insured shows up to impact whether their children receive treatment in addition to just how much careeven if the children themselves have coverage (Hanson, 1998).

Some Known Details About Health Insurance In Toccoa, Ga

Emergency situation divisions are represented as an expensive and inappropriate site of key care services, several uninsured individuals look for treatment in emergency situation divisions since they are sent out there by various other health care suppliers or have no place else to go. The chapter additionally presents info concerning the danger of being or coming to be without insurance: How does the possibility of being without insurance modification depending on chosen qualities, such as racial and ethnic identification, rural or metropolitan residency, and age? What are the probabilities for details populaces, such as racial and ethnic minorities, rural citizens, and older working-age individuals, of being uninsured?